The report ‘A Shaky Start to 2025, what’s next?’ explains that the UK political position is arguably the most stable it has been for nearly a decade, although a threat to global trade emerges from the United States with the new administration's trade policies.

While President Trump’s approach to import/export tariffs risks escalating trade disputes the broader impacts of this could indirectly threaten the UK food system at a time of slow growth, persistent inflation and tentative recovery.

James Walton, chief economist at IGD, said: “President Trump advocates for tariffs to protect US industry. If he implements new tariffs in his second term, UK food and drink businesses may be impacted. However, the US is not a primary partner for UK trade.

“While the short-term impact may be challenging for some, the longer-term effects will depend on how the global trade environment evolves and how businesses respond to changing geopolitical and economic conditions.”

The report shows a domestic picture of tentative recovery as 2025 kicked-off with muted business and shopper confidence and slow growth in GDP. Key highlights from the report:

- Trump presidency implications: Tariffs may threaten the UK food system and result in a general damping down of trade, growth and prosperity.

- Economic outlook: IGD expects food and drink inflation to be between 2.4% and 4.9% over the full year 2025.

- Consumer sentiment: Any positive outlook for consumer sentiment may be short-lived with increased concerns about the cost of living.

- Policy in 2025: A new Government food strategy will be delivered through a Government-wide health mission board.

Michael Freedman, head of economic and consumer insight at IGD, added: “The current combination of weak growth and inflation is a difficult one, threatening stagflation, which is hard to deal with via monetary policy.

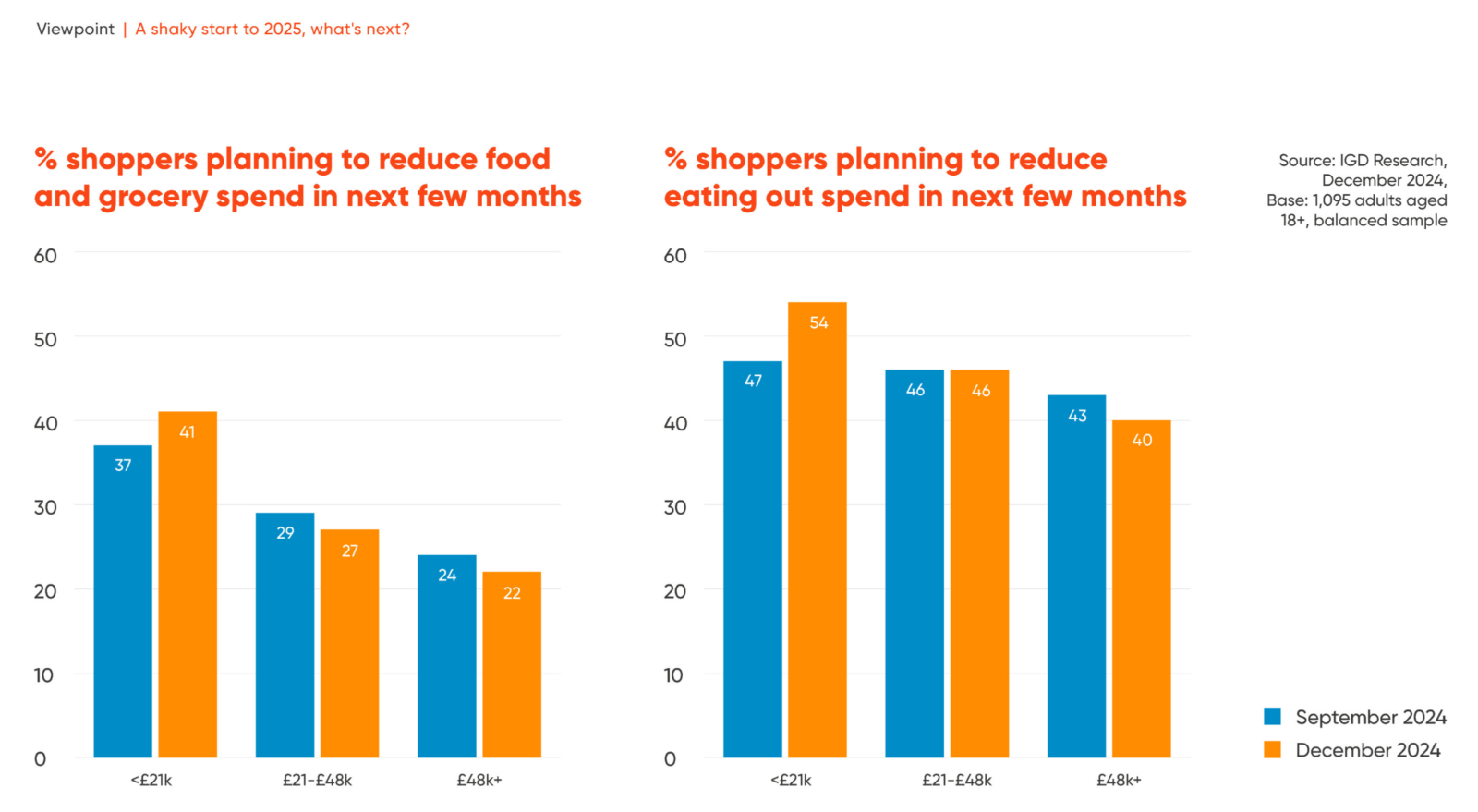

“Shoppers have become accustomed to saving money with loyalty cards and buying more products on promotion, with lower income groups planning to cut back their grocery and eating out spend. As many as 81% of Shoppers expect food prices to increase (+4% vs Sep’24) and 63% plan to use loyalty cards more (+4% vs Dec’23)."