According to the spring edition of the Lynx Purchasing Market Forecast, while the impact of the UK’s terrible weather at the start of the year has so far been limited, factors ranging from rising global demand for key products to disease in some farmed species are having an impact on prices.

“The overall CPI rate of food inflation was 1.9% in January, with food inflation at 1.8%,” said John Pinder, managing director at buying specialist Lynx Purchasing. “However, caterers tend to pay higher prices than the headline rate, which reflects deals and promotions by supermarkets.”

The spring forecast is an overview of market and pricing trends, and looks at the prospects for food pricing as foodservice operators plan menus for the key Easter trading period, and combines analysis of headline ONS inflation figures with exclusive insight from Lynx suppliers.

Pinder said: “Inevitably, our customers have been asking what the impact of the weather will be on their food costs. While the weather is always one of the biggest variables that we face on the supply side when calculating prices, so far the effects have been limited.

“Last year’s prolonged cold snap, which meant that crops couldn’t be planted until later than normal, actually had more impact than this year’s floods, which although were severe where they occurred, have been more localised.

“There were some short-term price spikes, such as higher prices for fresh fish during the periods when storms prevented fishing boats from going to sea, but those have largely now levelled off. However, the need to factor the use of agricultural land into flood defence planning is a longer term worry.”

Issues highlighted by the forecast as having a more immediate effect of food pricing include:

• Protected Geographical Indication (PGI) status for West Country beef from the end of March may limit supplies, as current rearing methods restrict the amount of beef which will meet the standard

• Rising demand for lamb from China and elsewhere is pushing up prices globally, with a likely knock-on effect for UK prices

• The Early Mortality Syndrome (EMS) virus devastating Asian farms will cause supply issues with tiger prawns until late 2015

• Quality issues with some salmon from Chile mean the North American market is sourcing more Scottish and Norwegian salmon, pushing up prices

However, there are opportunities for caterers willing to be flexible when planning menus. “With trade likely to be subdued until Easter bookings kick in, it’s more important than ever for operators to use the best value produce when it becomes available,” explained Pinder.

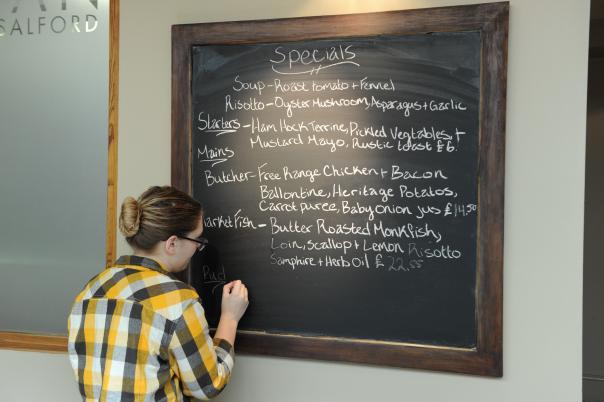

“British pork and poultry will represent good value compared to other meat this spring. Seasonally-available fish species such as monkfish, lemon sole and whiting work well on specials boards, especially accompanied by fresh seasonal vegetables, which are also in good supply.”

A free copy of the forecast can be downloaded from www.lynxpurchasing.co.uk/assets/media/lynx_spring_14.pdf