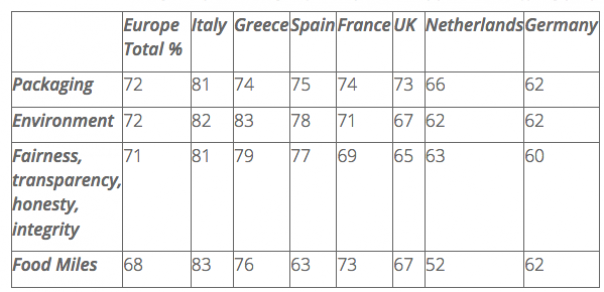

Carried out by market research agency IRI on 3,300+ EU consumers, the survey found that 70% prefer to buy from companies that are “fair and transparent, respect the environment, use recyclable packaging and have low food miles.”

Of the seven countries surveyed, Italy came out on top as the most ethical, scoring the highest in three out of four questions asked regarding their shopping habits and expectations for the future of grocery retail: packaging (81%), food miles (83%) and fairness (81%).

Greece topped the final question, showing preference for retailers “willing to respect the environment” (83%) while the UK came in fifth place.

Senior regional insights manager Olly Abotorabi, said: “Conscious consumerism is on the rise and shoppers are more aware than ever of the ethical and environmental impact their purchases can have on the environment.

“The sustainability credentials of retailers can be a decisive factor for many European consumers’ purchasing decisions. However, it’s clear that the price point of certain categories, such as fresh local produce, remains a barrier to growth.”

Top trends from the 2018 European Shopper Survey include:

Fresh is best: Shoppers have a much stronger connection with locally produced fresh food, with 29% preferring local national brands.

Spain (40%) and Greece (36%) scored the highest for their preference towards buying locally-produced fresh food, compared to an average of 32% across all countries.

Millennial movers: Older generations show a propensity towards purchasing local products while, perhaps surprisingly, younger millennials appear marginally less concerned about product origin and environmental impact and are more inclined to buy established international brands which are perceived to be more innovative and offer a superior brand experience.

High expectations: Across all age groups, shoppers’ top three future expectations showcase a clear consensus on delivering products with less plastic packaging (43%); more local brands in-store (43%) and higher product quality (38%).

Millennials also want to see improvements in in-store convenient, ready-to-eat food and drink options.