Published this month, the Prove It: Breaking Bread report predicts the UK's £7.8bn bread market will grow by 15% to reach a value of £9bn by 2026. Délifrance surveyed 1,000 UK adults who regularly eat bread and found that a third of those involved in the research said they consumed bread every day.

The report says business have a ‘huge opportunity’ to take a slice of this growth by embracing trends such as demand for speciality and world breads, products using regeneratively farmed ingredients and bread that offers health benefits.

Stéphanie Brillouet, marketing director at Délifrance, commented: “We take a look at the trends shaping the category, from the continued growth of sourdough to the opportunities offered by breads from across the globe.

“We also take a deep dive into consumer attitudes to bread and examine what drives purchasing decisions, how consumption differs in and out-of-home (OOH), and the impact of consumers’ environmental and economic concerns.”

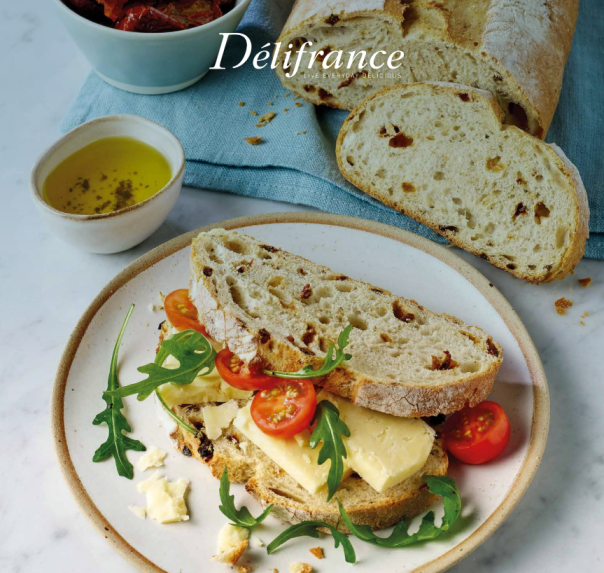

The top five fillings in bread, according to the survey were: cheese, chicken, BLT, ham and egg. The research revealed plenty of love for the classics - baguettes, rolls and sliced bloomer bread but there is also a lot of interest in products such as wraps and Italian breads.

According to the research 63% of those surveyed said sustainability impacts their purchase decision making at least some of the time and 57% noted they would consider paying extra for more sustainable bread products.

Food trend expert Alexandria Harris said: “Sustainability is a fundamental expectation rather than a niche concern.”

Other key insights from the report include:

- 63% said they regularly consume bread at breakfast, 62% said they regularly consume bread at lunch, 37% said they regularly consume bread at dinner and 42% said they snack on bread regularly

- 25% of consumers who eat bread at home say they are consuming more of it

- 70% of consumers who are eating more bread at home say they are also eating more bread out of home

- 41% of consumers say they buy bread for the taste. This is second only to freshness, which was cited by 44% of consumers

- The average retail price of an 800g loaf of bread has risen more than 30p in the past two years

- Over a quarter of consumers cite a drop in their household budget as a reason for increasing their in home consumption of bread

- Almost a third (30%) of consumers who are eating more bread at home and out of home are doing so for health reasons

Read the full ‘Breaking Bread’ report below.